Income Taxation from Rental Income in Canada

At RAPC, We are committed to providing rental property owners and individuals with rental income the guidance and support they need to navigate the complexities of income taxation in Canada and achieve their financial goals.

Challenges in Reporting Rental Income

Those with rental income face specific challenges when it comes to reporting their rental income for tax purposes in Canada. Some of the key challenges include

Income Documentation

Effectively documenting your rental income, especially if it's received in cash, is crucial for accurate reporting and compliance

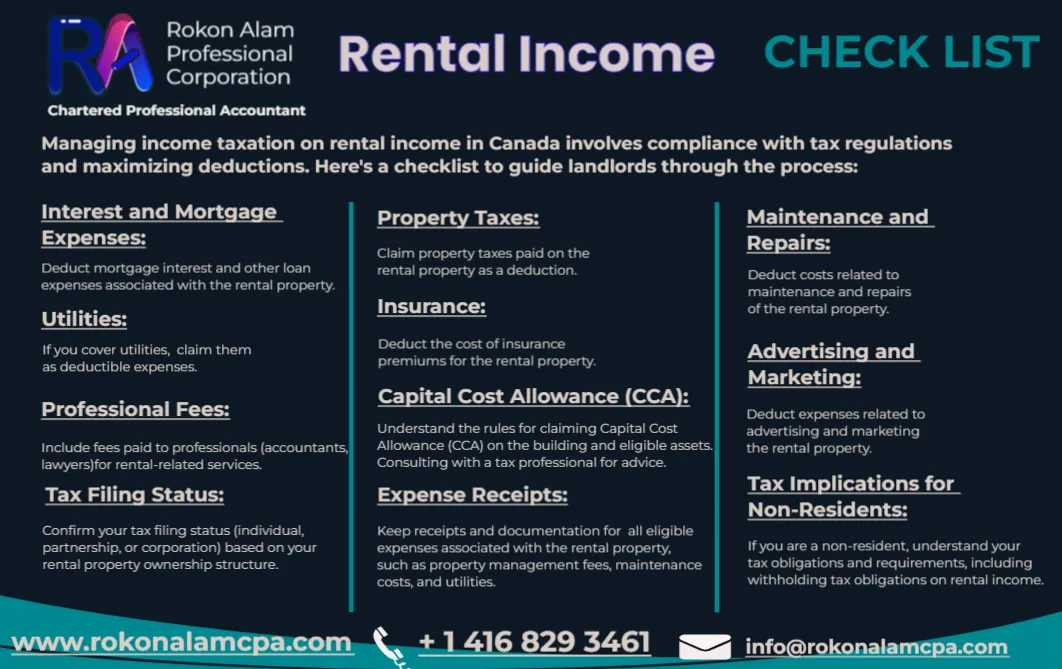

Deductions and Expenses

Understanding eligible deductions and business expenses related to your rental property can significantly impact your taxable income

Proper Reporting

Properly reporting rental income, including distinguishing between capital and income expenses, is vital for accurate tax filing

How We can Help?

At RAPC, we understand the unique challenges faced by those with rental income when it comes to income taxation. We are dedicated to assisting rental property owners and individuals with rental income in various ways

Income Documentation

We provide guidance on effectively documenting rental income to ensure accurate reporting.

Deductions and Expenses

We identify eligible deductions and expenses applicable to your rental property, helping you reduce your tax liability

Proper Reporting

We assist in properly distinguish between capital and income expenses for accurate tax filing.

Tax Planning

We develop and implement tax planning strategies to optimize deductions, credits, and minimize tax liability for rental income

Personalized Guidance

Our services are tailored to the unique needs of individuals with rental income, providing personalized support

Peace of Mind

Experience peace of mind, knowing that experts are handling your tax matters and making the most of your rental income.

Start the Conversation

Are You a Non-resident and have rental property in Canada

If you are a non-resident having rental income in Canada and are looking for expert guidance and support in managing your income tax responsibilities, We are here to help. We simplify the complexities of the Canadian tax system, ensuring that you can reduce your tax burden and maximize your rental income.