Personal Tax Return

Because Your Life Isn’t “Standard,”

Neither Is Your Tax Return

Over the years, as a CPA, I’ve met teachers, professionals, newcomers, parents, retirees— all with one thing in common: their tax situation was never as simple as it looked on paper.

Life changes.

Income changes.

Responsibilities change.

Yet too often, people are rushed through tax season like a number in a system.

That’s not how I work.

When you file your personal tax return (T1) with me, I take the time to understand your story—your income, your family, your goals, and your concerns.

Because accuracy matters.

Peace of mind matters.

And you deserve personal attention from a CPA who genuinely cares.

If you want your taxes done thoughtfully, carefully, and personally, I’m here.

Personal Tax Return at a Glance

A personal tax return in Canada refers to the annual tax filing that individual residents of Canada are required to submit to the Canada Revenue Agency (CRA) to report their income and calculate the amount of income tax they owe or are entitled to receive as a refund. This tax return is typically due by April 30th of the year following the tax year, although the deadline may be extended to June 15th if you, your spouse, or common-law partner is self-employed.

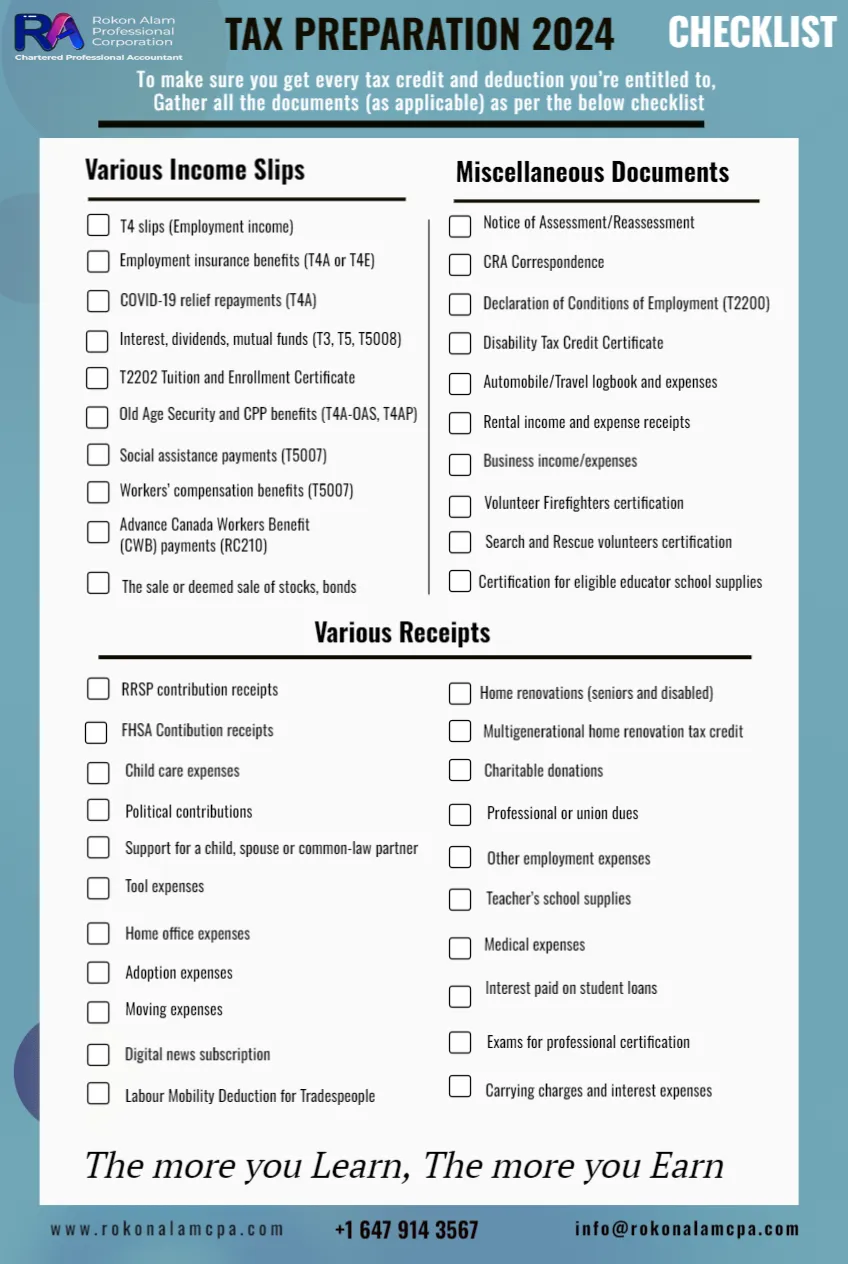

It's important for individuals in Canada to keep accurate records of their income and expenses throughout the year to ensure they can file an accurate tax return. Many Canadians also benefit from using tax preparation software or consulting with a tax professional to navigate the complex tax system and maximize deductions and credits available to them.

Tax Credits Vs. Tax Deductions

In Canada, tax credits and tax deductions are both mechanisms that can help individuals reduce their taxable income and, consequently, their overall tax liability. However, they work differently in terms of how they lower your tax bill:

Tax deductions reduce your taxable income before calculating your taxes, whereas tax credits directly reduce the amount of tax you owe. Both deductions and credits can be valuable in lowering your overall tax bill, but they are applied at different stages of the tax calculation process and have distinct eligibility criteria and benefits. Understanding how deductions and credits work can help individuals optimize their tax planning and minimize their tax liabilities.

Why You Consider our Personal Tax Service

It's essential to keep accurate records and receipts for any deductions you plan to claim, as the Canada Revenue Agency (CRA) may request documentation to support your claims. l eligible deductions and credits on your personal tax return.

It's important to note that tax laws and credits may change from year to year, and the availability of certain credits can depend on your province or territory of residence. To ensure you claim all the credits and deductions you are eligible for, consider using tax preparation software, consulting with a tax professional, or referring to the Canada Revenue Agency (CRA) website for up-to-date information.

Case Study

Let's hear out some of the success stories

Beyond Numbers: Personal Tax Success Stories with RAPC

RAPC made tax season a breeze for me. Their attention to detail and expert knowledge helped me maximize my deductions and credits, resulting in a substantial refund. I can't thank them enough for their personalized service.

Aisha Patel

As a small business owner, tax time used to be incredibly stressful. RAPC's personal tax services changed that completely. They guided me through the process, helping me save money and ensuring compliance. I highly recommend their services!

Zakir Hussain

RAPC's expertise in personal tax filing is unmatched. They navigated the intricacies of my diverse income sources with precision, ensuring maximizing returns. The peace of mind I gained from their thorough approach is invaluable.

Fazle Rabbi